Independent Financial Advisors (IFAs) in South Africa serve as trusted guides for personal and business financial planning. They offer unbiased, personalized strategies, navigating complex investments, retirement, tax, and risk management. With access to diverse products and market insights, IFAs tailor solutions and help clients optimize savings. Regulated by the FAIS Act, they uphold ethical standards and client protection. IFAs empower South Africans to make informed decisions, achieve financial milestones, and secure long-term stability through personalized planning and regular reviews. Choosing a registered, experienced IFA with clear communication is crucial for navigating South Africa's dynamic financial sector.

“In the competitive financial landscape of South Africa, Independent Financial Advisors (IFAs) play a pivotal role in guiding individuals and businesses towards secure and prosperous futures. This article delves into the world of IFAs in SA, exploring their definition, benefits, regulatory framework, key services, selection tips, and successful client collaborations. Understanding the role of these professionals is essential for navigating South Africa’s financial landscape effectively.”

- Understanding Independent Financial Advisors: Definition and Role in South Africa

- The Benefits of Engaging an Independent Financial Advisor in SA

- Regulatory Framework: Ensuring Trust and Protection for Clients

- Key Services Offered by IFAs in the South African Market

- Choosing the Right IFA: What to Consider When Selecting a Financial Advisor

- Case Studies: Successful Collaborations Between IFAs and Clients

Understanding Independent Financial Advisors: Definition and Role in South Africa

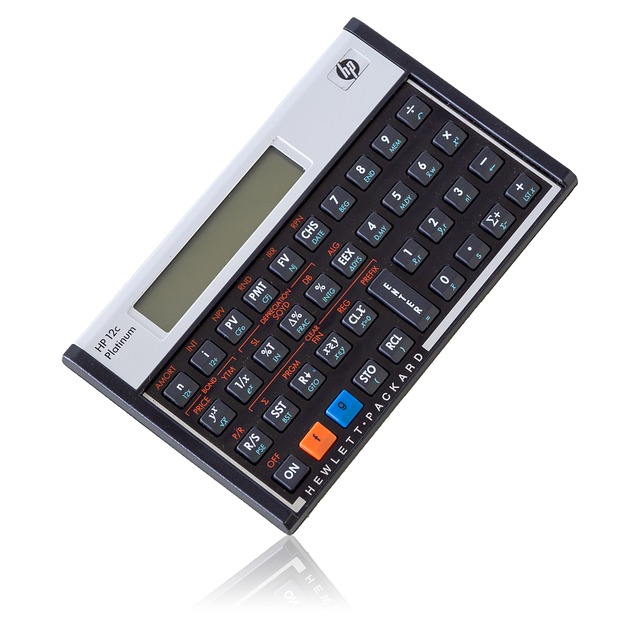

Independent Financial Advisors (IFAs) in South Africa play a pivotal role in shaping the financial well-being of individuals and businesses alike. Unlike their in-house counterparts, IFAs are not tied to any specific financial institution or product provider. This freedom allows them to offer unbiased advice and tailored solutions that best suit their clients’ unique needs and goals. They serve as trusted guides, navigating the complex landscape of investments, retirement planning, tax strategies, and risk management.

In South Africa’s dynamic financial sector, IFAs are instrumental in providing objective insights and helping clients make informed decisions. Their expertise lies in assessing individual circumstances, creating comprehensive financial plans, and regularly reviewing and adjusting these strategies as life circumstances change. By staying abreast of regulatory changes and market trends, IFAs ensure their clients’ investments and savings are optimized for both short-term gains and long-term financial security.

The Benefits of Engaging an Independent Financial Advisor in SA

Engaging an independent financial advisor in South Africa offers a range of benefits for individuals and businesses looking to navigate the complex financial landscape. These advisors provide unbiased, personalized advice, enabling clients to make informed decisions about their investments, retirement planning, tax strategies, and wealth management.

With access to a diverse range of financial products and services from various institutions, independent advisors can tailor solutions to meet unique client needs. They offer valuable insights into market trends and regulatory changes, helping South Africans stay ahead of the curve. Additionally, they foster long-term relationships, providing ongoing support and adjustments as life circumstances evolve, ensuring clients’ financial goals remain on track.

Regulatory Framework: Ensuring Trust and Protection for Clients

The regulatory framework in South Africa plays a pivotal role in shaping the landscape for Independent Financial Advisors (IFAs). This framework is designed to uphold ethical standards, protect clients’ interests, and foster public trust in the financial advisory sector. The Financial Advisory and Intermediary Services Act (FAIS) serves as the cornerstone, establishing clear guidelines for IFA operations. Under this act, IFAs are required to adhere to strict rules regarding client confidentiality, fair treatment, and disclosure of potential conflicts of interest.

By adhering to these regulations, South African IFAs ensure that clients receive unbiased advice tailored to their financial goals and risk profiles. The regulatory environment also enables clients to have recourse if they believe their rights have been infringed upon. This protection is vital in maintaining a transparent and trustworthy relationship between advisors and their clientele, which is essential for the growth and sustainability of the IFA industry in South Africa.

Key Services Offered by IFAs in the South African Market

Independent Financial Advisors (IFAs) in South Africa play a pivotal role in shaping the financial landscapes of individuals and businesses across the nation. Their key services encompass a wide range, catering to diverse financial needs. IFAs offer personalized investment advice, helping clients navigate complex markets and create tailored portfolios aligned with their risk appetites and long-term goals. This includes diversifying investments across various asset classes such as stocks, bonds, and property, ensuring optimal returns while managing potential risks.

Beyond investment strategies, IFAs provide comprehensive financial planning services. They assist in budgeting, tax planning, retirement fund management, and estate planning. By offering expert guidance on these matters, IFAs empower South Africans to make informed decisions about their monetary futures, ensuring financial stability and security for themselves and their families.

Choosing the Right IFA: What to Consider When Selecting a Financial Advisor

When selecting an Independent Financial Advisor (IFA) in South Africa, it’s crucial to consider several key factors to ensure you make an informed choice. Look for advisors who are registered with a reputable regulatory body like the Financial Sector Conduct Authority (FSCA). Their registration status and disciplinary history are indicators of their professionalism and trustworthiness. Verify their experience and expertise in areas relevant to your financial needs, whether it’s retirement planning, investment management, or tax advice.

Reputation and client testimonials are also vital. Research their past clients’ experiences and feedback to gauge the quality of their service. A good IFA should offer personalized advice tailored to your unique circumstances while keeping your best interests at heart. They should be accessible, transparent in their communication, and equipped to guide you through complex financial matters with clarity and ease.

Case Studies: Successful Collaborations Between IFAs and Clients

Successful collaborations between Independent Financial Advisors (IFAs) and their clients in South Africa illustrate the transformative power of personalized financial planning. Many IFAs have helped individuals achieve significant milestones, from retirement security to wealth accumulation. For instance, an IFA working with a young professional might design a strategy that includes saving for both short-term goals like a home deposit and long-term objectives such as early retirement. Through regular reviews and adjustments, this partnership ensures the client stays on track despite life’s twists and turns.

Case studies also highlight the value of IFAs in navigating complex financial landscapes. They can demystify investment options, providing clarity during uncertain economic times. For example, an IFA might guide a client through market volatility by rebalancing their portfolio or suggesting alternative investments. These collaborations often result in improved financial health and peace of mind, demonstrating the critical role Independent Financial Advisors play in empowering South Africans to take control of their financial futures.